Our Financial Education Partner, BALANCE

Here at OE Federal, we care about your financial wellness. Did you know that you have access to the services of our financial education partner, BALANCE?

How to Help Keep Your Important Information Safe

Identity theft is one of the most despicable crimes out there. Here are seven ways to help protect yourself:

Fake Check Scams on the Rise

Check fraud is one of the more common forms of fraud. In early September, the Better Business Bureau (BBB) released a report warning about a spike in fake check scams. These scams have now reached approximately 500,000 victims each year.

Don’t Get Caught in a College Degree Scam

College degree scams can be tough to spot. Unfortunately, getting duped by one can mean losing out on lots of time and money. Here’s what to know about college scams.

Browsing unfamiliar sites

Our goal at OE Federal is to keep you and your finances safe. So when browsing an unfamiliar site, ask these questions to make sure it’s safe:

Trick or Cheat: Halloween Scams to Avoid

Halloween is a time for fun and frights, but some scams can be downright spooky. Here are a few to keep an eye on:

Collect and Protect Important Documents

Keeping sensitive documents safe can give you peace of mind in case of unexpected events, and ensure you have documents ready when needed. Below, our friends at BALANCE have put together which documents you should protect and options for doing so.

Don’t Answer Calls from These Area Codes

Robocalls are the worst. Easily, one the most annoying inventions of the 21st century. Unfortunately, those phone calls can do a lot more than just disrupt dinner.

ID Navigator Powered by NortonLifeLock

No one can prevent all identity theft, so staying informed and knowing what to do if your identity is threatened can give you greater peace of mind. ID Navigator Powered by NortonLifeLock provides eligible Visa cardholders with free tools to help keep you informed of potential threats to your identity so you can act quickly.

10 Tips for ATM Safety

Using a compromised ATM can mean risking identity theft and/or having cash stolen. With this simple machine, all it takes is a few short minutes for a victim’s life to meet disaster. Here are tips to help you keep your ATM transactions secure.

Lawn-Care Scams

Spring is here, and lawn-care scams are sprouting up everywhere. And unlike that brown spot in the grass, they’re not easy to see. Here’s what’s important to know about these scams and how to stay safe.

Online & Mobile Safety Tips

Your Online Safety Comes First

At OE Federal, not only do we protect your finances; we strive to keep you safe online. It’s important to remember that OE Federal will never contact you requesting your personal information including: online banking login information, full debit or credit card information, or full SSN.

Below are just a few things to keep an eye out for to help keep you safe while online or using your mobile device.

What are the advantages of a HELOC?

There are a lot of advantages to owning your home. It's an investment that can make you some money over time, it's a place to create memories, and it can also help you out when extra cashflow is needed. A Home Equity Line of Credit (HELOC) is an open credit line that is secured by the paid value of the borrower’s home. Once approved for a HELOC, borrowers can spend the funds however they choose.

Should I use a HELOC to pay off credit card debt?

Is it a good idea to use my home’s equity to pay off credit card debt?

Your home’s equity can be a versatile financial tool, but using it to pay off your credit card debt can potentially be risky. Let’s take a look at the pros and cons of using a HELOC to pay off credit card debt so you can make an informed decision about this financial move.

OE Federal and HomeAdvantage

Get Rewarded for Buying with OE Federal and HomeAdvantage!

Buying a new home can be one of the largest and most stressful financial transactions you may ever make. OE Federal and HomeAdvantage make it easy and affordable by offering all the tools you need, right in one place!

All you have to do is fill out a mortgage application with OE Federal and set up an account with HomeAdvantage, then we’ll take care of all the heavy lifting.

Preparing to Buy Your First Home

Buying a home is an amazing goal, but the challenges of being a first-time homeowner can be intimidating. Let’s take a look at a few guidelines to help take some of the stress out of the decision.

Adjustable or fixed-rate mortgage, which is right for me?

If you’re mortgage shopping, you may be overwhelmed by the number of options. Dozens of lenders, each with their own rates, terms, conditions and costs, can make the decision feel that way. But it doesn’t have to be that difficult! The choice of which mortgage to go with starts with a simple question: fixed-rate or adjustable? There are many different terms, points and rates associated with each, but narrowing your search to a category can really simplify the process.

Shop & Earn with OE Federal Rewards Program

INTRODUCING

With this program, you’ll be able to easily earn and redeem points using your Visa STEEL Rewards Credit Card.

Union Rebate Program

OE Federal’s Union Rebate Program is ongoing throughout the year. The program donates 1% of the annual interest paid on a Visa STEEL and STEEL Rewards Credit Card to the preferred charity of a local Union. That means the more the card gets used, the more money that is given to the designated charity.

Go Paperless

Tired of sifting through stacks of paper statements? Ditch ’em! Not signed up for eStatements yet?

Get enrolled today!

A Guide to Opening Your First Credit Card

Opening your first credit card is one of the rites of passage into genuine adulthood, but with so much conflicting information, it can all get confusing fast! Let OE Federal walk you through the process to help you build a strong credit score and credit history that will serve you well throughout your life.

Five Reasons to Pay Yourself First

Paying yourself first, or prioritizing your savings, is the golden rule of personal finance.

Start small with just $100 each payday, or even a dollar day (our mobile app makes this easy), and watch your savings grow! Read below for 5 excellent reasons why you should start paying yourself today!

Digital Wallet

Interested In A Faster, More Secure Way Of Using Your OE Federal Debit Or Credit Card?

Use Digital Wallet!

How to get more bang for your buck at the pump

Just when you think they can’t possibly jump any higher, gas prices start rising again. They’ve long passed the $5 mark in much of the country, and in some areas they’ve even gone beyond $6 a gallon. This means it’ll cost the average American close to $100 just to fill a 16-gallon tank. With prices peaking on so many other goods, the pain at the pump is real.

There isn’t much you can do about the cost of gas, but there are ways to help make your money go a little further.

Six Reasons to Switch to eStatements

Quick, convenient and clutter-free, eStatements are the way to secure your account info.

Your eStatements work similarly to paper statements, except for the fact that they’re delivered electronically. At the end of each statement period, you’ll get an email from OE Federal informing you that your eStatement is ready to view through the online app or another secure means. Once you access the eStatement, you’ll find it has all the information you’re used to getting with your paper statements. You can also access your eStatement by logging into your online banking site or app at any time throughout the month.

Here are six reasons to consider switching to eStatements.

Why Your Child Should Have a Savings Account

Now is the perfect time to teach your kids about responsible money management. One of the best ways to do so is by opening a savings account in their name and helping them learn the basics of smart saving habits. Let’s take a look at why it can be a good idea to open a savings account for your child.

All You Need to Know about Share Certificates

No one wants to play around with their savings. You work hard for your money, and if you’ve built up a sizable nest egg, you’ll want to park it somewhere safe where it will have the best chance at growth.

If you’re looking for a place to keep your savings, a Share Certificate at OE Federal Credit Union can be a fantastic option. Here’s why this savings product might be the perfect choice for you:

Is Your Child Ready for a Teen Checking Account

Every kid likes to do things on their own.

So let them feel independent with their own teen checking account. This will be their first step towards a lifetime of important financial responsibility.

Teen checking accounts are a great way to start teaching your teen money management. This gives you the opportunity to start talking about spending, saving, and budgeting. You can even set up a simple budget to help them track their spending. Taking account for typical expenses such as school lunches, gas money, and weekend fun is a good place to start.

Building Financial Resilience

In today’s fast-paced world, we face many financial challenges as we juggle a lot of responsibilities. The constant pressure to earn enough for covering day-to-day expenses while remembering to put away money for your financial goals never lets up. To make it even more difficult, life only gets more expensive as time goes on. However, despite the inherent hurdles, overcoming financial stress and living a financially fit life is very doable. Let’s take a look at key strategies for building financial resilience!

Youth Accounts

Managing money is a foundational life skill.

Managing money is a foundational life skill. That’s why it’s best to give your kids a head start on money management and saving. As a parent or guardian, remember that the lessons you plant today will take root and blossom, enriching your child’s life for years to come. Here’s a few points to ponder:

Financial Scams During Times of Disaster

During natural disasters, we often see an increase in financial scams impacting our communities. These range from fake charities, to unsolicited “help” from FEMA, to increased scare and account takeover fraud tactics.

Avoid Rental Listing Scams

Whether you’re looking into a short-term or long-term rental, it’s important to stay diligent and avoid being scammed!

Rental listing scams can unfold in a few ways. Scammers can steal legitimate rental listings for real places and pretend to be the landlord. Sometimes scammers use social media groups to post made-up listings for places that aren’t actually available to rent — and sometimes for place that don’t even exist. In either case, the scammer will rush you into paying an application fee, deposit, and/or first month’s rent, and promise to get you the keys right away — but instead, they’ll disappear. You’ll be left without your money and with no place to move into.

What is a Deepfake Scam?

Fraudsters are getting craftier with technology, especially thanks to recent advancements in Generative Artificial Intelligence (GenAI). One particularly convincing type of scam leverages deepfakes to gain your trust.

Taxes & Scams

If you believe you’ve been contacted by an imposter trying to scam you, report it by clicking here!

Don’t be tricked by fraudsters pretending to be from OE Federal Fraud Department

Stopping fraud remains an ongoing challenge. Fraudsters and scammers are now using more sophisticated ways to try and mislead you into sharing account information and personal data by posing as someone from OE Federal.

Scam-Proof Your Financial Life

Fraud seems to grow every year. One of the most popular forms of fraud is known as spoofing where an email, phone call, or website is disguised as being from a trusted or well-known source. This means you must be more aware of how to spot a spoofing scam. We want to keep your identity and money secure. Here’s how to identify and avoid spoofing fraud online.

Your Funds Are Insured

YOUR MONEY IS SAFE AT OE FEDERAL

As an OE Federal member, your accounts are insured up to $250,000 by the National Credit Union Share Insurance Fund (NCUSIF). All federal credit unions are insured by this U.S. Government-backed fund.

Ways to Tell if a Website is Safe

In today’s world, where many people spend hours of each day browsing the internet, staying safe online is paramount. The web is rife with scammers employing sophisticated tactics to get at your money and information. Fortunately, with protective measures, you can easily avoid unsafe websites. Here are ways to tell if a website is safe.

Don’t Get Caught in a Vacation Rental Scam

With prices rising on hotel stays, many vacationers are choosing to rent private homes or apartments on sites like Airbnb. Unfortunately, though, vacation rental scams are rising, too. Here’s all you need to know about these scams and how to avoid them.

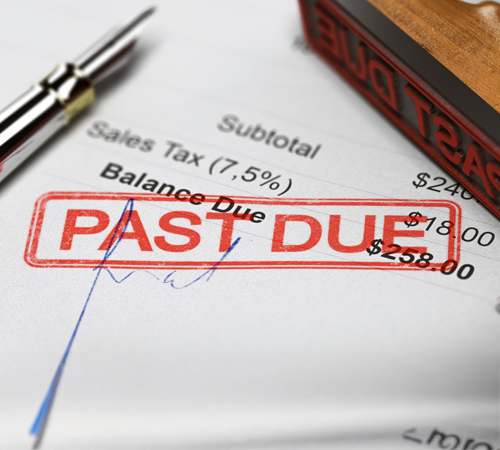

Don’t Get Caught In A Debt Collection Scam

No one likes to be in debt. It’s a downward spiral that never seems to end, and it’s an expensive burden to carry, too. Unfortunately, scammers often exploit the feelings of helplessness and overwhelm to lure victims into their debt-collection scams. Let’s take a look at these scams and how to keep yourself from falling victim.

Beware of Smishing (SMS Scams!)

In a world where apps can almost run our lives for us, the humble SMS has outlived them all – and it’s still going strong. Unfortunately, though, texting has come under attack as one of the most vulnerable mediums for identity theft and more.

Here’s what you need to know about a text message-based scam called “smishing.”

Scams Target Older Americans at an Alarming Rate

The number of elderly victims impacted by fraud has risen at an alarming rate. In 2021, over 92,000 victims over the age of 60 reported losses of $1.7 billion. This is a 74% increase in losses over 2020.

Job Scams

Job-hunting can be stressful, but getting caught in a job scam can bring that stress to a whole new level. Stay alert and stay safe.

Is Plaid Safe to Use?

"When using financial apps, I’m often redirected to the Plaid network and asked to give personal information. Can I feel safe using Plaid?"

So you’re asked to share your banking information and alarm bells in your head start ringing — as they should! The good news, though, is that, if the financial app you’re using is powered by Plaid, it’s safe to use. Plaid is a reputable company that uses encryption and industry-standard security measures to protect your information.

Micro-Deposit Scams

Scammers are always upping their game, and they’ve recently pulled out an old trick: the micro-deposit scam. Unfortunately, too many people have already fallen victim, and we don’t want anyone else getting caught in the trap. To that end, we’ve compiled this guide on micro-deposit scams, how they play out and what you can do if you’re targeted.

Beware of tax season scammers

It’s tax season, and the scammers are at it again! Beat them at their game by knowing what to look out for.

The Benefits of Using Mobile Payments

No more fumbling through your wallet at checkout or forgetting it at home, now you can pay with your phone!

81% of Americans own smartphones and contactless payments by digital wallet and mobile payment apps are now more popular than ever. Contactless payment is also becoming increasingly available at checkout counters across the country, with six in every 10 retailers accepting digital payments, according to research by the National Retail Federation.

Beware of the Pending Package Scam

Everyone loves a surprise package, and scammers are taking the excitement out of that experience by using bogus packages as a cover for a nefarious scam that tricks victims into sharing personal information. Here’s all you need to know about the pending package scam:

How Can I Protect Myself from Payment App Scams?

There’s been an increase in scams through mobile payment apps such as Cash App, Venmo, Zelle, and more. These apps are still very safe to use, but we want to help protect you.

Get More with OE Federal: Member-Only Deals!

Imagine saving money on everyday essentials and big purchases just by being an OE Federal member. That’s the beauty of community trust and care! With Love My Credit Union Rewards, you get access to unbeatable deals and discounts. Here’s a glimpse of the savings you can enjoy:

Transform Your Home Equity into Opportunity: Top 4 Uses

Unlock the Power of Your Home’s Equity! With interest rates dropping, now is the perfect time to leverage your home’s value. Imagine receiving a lump sum of cash within days, ready to use for anything you need. Whether it’s home improvements, debt consolidation, or an emergency fund, the possibilities are endless. Just remember, this loan uses your home as collateral, so choose your investments wisely.

Stress-Free RV Shopping & Financing

Q: It’s vacation time! We’re thinking about buying an RV, but RV lots seem so intimidating! How can we fight that stress?

A: Nothing beats the freedom of a road trip, and with an RV, the journey becomes part of the adventure. Here are some tips to make buying an RV less stressful:

Never Miss a Payment with EasyPay

Spend less time paying bills! Let EasyPay by OE Federal handle your payments stress-free. Our secure online platform simplifies managing your mortgage, personal loan, auto loan, or credit card payments. Accessible 24/7, anywhere you are.

Which Purchases Should I Charge to My Credit Card?

Your credit score, which is the key to long-term loans at favorable rates, employment opportunities and more, depends on your credit card usage. You want to make sure you use your cards, but you don’t want to spend more than you can pay. In addition, there are some purchases that are best off being made on a credit card.