How to Help Keep Your Important Information Safe

Identity theft is one of the most despicable crimes out there. Here are seven ways to help protect yourself:

Fake Check Scams on the Rise

Check fraud is one of the more common forms of fraud. In early September, the Better Business Bureau (BBB) released a report warning about a spike in fake check scams. These scams have now reached approximately 500,000 victims each year.

Don’t Get Caught in a College Degree Scam

College degree scams can be tough to spot. Unfortunately, getting duped by one can mean losing out on lots of time and money. Here’s what to know about college scams.

Browsing unfamiliar sites

Our goal at OE Federal is to keep you and your finances safe. So when browsing an unfamiliar site, ask these questions to make sure it’s safe:

Collect and Protect Important Documents

Keeping sensitive documents safe can give you peace of mind in case of unexpected events, and ensure you have documents ready when needed. Below, our friends at BALANCE have put together which documents you should protect and options for doing so.

ID Navigator Powered by NortonLifeLock

No one can prevent all identity theft, so staying informed and knowing what to do if your identity is threatened can give you greater peace of mind. ID Navigator Powered by NortonLifeLock provides eligible Visa cardholders with free tools to help keep you informed of potential threats to your identity so you can act quickly.

Trick or Cheat: Halloween Scams to Avoid

Halloween is a time for fun and frights, but some scams can be downright spooky. Here are a few to keep an eye on:

Lawn-Care Scams

Spring is here, and lawn-care scams are sprouting up everywhere. And unlike that brown spot in the grass, they’re not easy to see. Here’s what’s important to know about these scams and how to stay safe.

Don’t Answer Calls from These Area Codes

Robocalls are the worst. Easily, one the most annoying inventions of the 21st century. Unfortunately, those phone calls can do a lot more than just disrupt dinner.

10 Tips for ATM Safety

Using a compromised ATM can mean risking identity theft and/or having cash stolen. With this simple machine, all it takes is a few short minutes for a victim’s life to meet disaster. Here are tips to help you keep your ATM transactions secure.

Financial Scams During Times of Disaster

During natural disasters, we often see an increase in financial scams impacting our communities. These range from fake charities, to unsolicited “help” from FEMA, to increased scare and account takeover fraud tactics.

Avoid Rental Listing Scams

Whether you’re looking into a short-term or long-term rental, it’s important to stay diligent and avoid being scammed!

Rental listing scams can unfold in a few ways. Scammers can steal legitimate rental listings for real places and pretend to be the landlord. Sometimes scammers use social media groups to post made-up listings for places that aren’t actually available to rent — and sometimes for place that don’t even exist. In either case, the scammer will rush you into paying an application fee, deposit, and/or first month’s rent, and promise to get you the keys right away — but instead, they’ll disappear. You’ll be left without your money and with no place to move into.

Online & Mobile Safety Tips

Your Online Safety Comes First

At OE Federal, not only do we protect your finances; we strive to keep you safe online. It’s important to remember that OE Federal will never contact you requesting your personal information including: online banking login information, full debit or credit card information, or full SSN.

Below are just a few things to keep an eye out for to help keep you safe while online or using your mobile device.

What is a Deepfake Scam?

Fraudsters are getting craftier with technology, especially thanks to recent advancements in Generative Artificial Intelligence (GenAI). One particularly convincing type of scam leverages deepfakes to gain your trust.

Taxes & Scams

If you believe you’ve been contacted by an imposter trying to scam you, report it by clicking here!

Don’t be tricked by fraudsters pretending to be from OE Federal Fraud Department

Stopping fraud remains an ongoing challenge. Fraudsters and scammers are now using more sophisticated ways to try and mislead you into sharing account information and personal data by posing as someone from OE Federal.

Scam-Proof Your Financial Life

Fraud seems to grow every year. One of the most popular forms of fraud is known as spoofing where an email, phone call, or website is disguised as being from a trusted or well-known source. This means you must be more aware of how to spot a spoofing scam. We want to keep your identity and money secure. Here’s how to identify and avoid spoofing fraud online.

Your Funds Are Insured

YOUR MONEY IS SAFE AT OE FEDERAL

As an OE Federal member, your accounts are insured up to $250,000 by the National Credit Union Share Insurance Fund (NCUSIF). All federal credit unions are insured by this U.S. Government-backed fund.

Ways to Tell if a Website is Safe

In today’s world, where many people spend hours of each day browsing the internet, staying safe online is paramount. The web is rife with scammers employing sophisticated tactics to get at your money and information. Fortunately, with protective measures, you can easily avoid unsafe websites. Here are ways to tell if a website is safe.

Don’t Get Caught in a Vacation Rental Scam

With prices rising on hotel stays, many vacationers are choosing to rent private homes or apartments on sites like Airbnb. Unfortunately, though, vacation rental scams are rising, too. Here’s all you need to know about these scams and how to avoid them.

Don’t Get Caught In A Debt Collection Scam

No one likes to be in debt. It’s a downward spiral that never seems to end, and it’s an expensive burden to carry, too. Unfortunately, scammers often exploit the feelings of helplessness and overwhelm to lure victims into their debt-collection scams. Let’s take a look at these scams and how to keep yourself from falling victim.

Beware of Smishing (SMS Scams!)

In a world where apps can almost run our lives for us, the humble SMS has outlived them all – and it’s still going strong. Unfortunately, though, texting has come under attack as one of the most vulnerable mediums for identity theft and more.

Here’s what you need to know about a text message-based scam called “smishing.”

Scams Target Older Americans at an Alarming Rate

The number of elderly victims impacted by fraud has risen at an alarming rate. In 2021, over 92,000 victims over the age of 60 reported losses of $1.7 billion. This is a 74% increase in losses over 2020.

Job Scams

Job-hunting can be stressful, but getting caught in a job scam can bring that stress to a whole new level. Stay alert and stay safe.

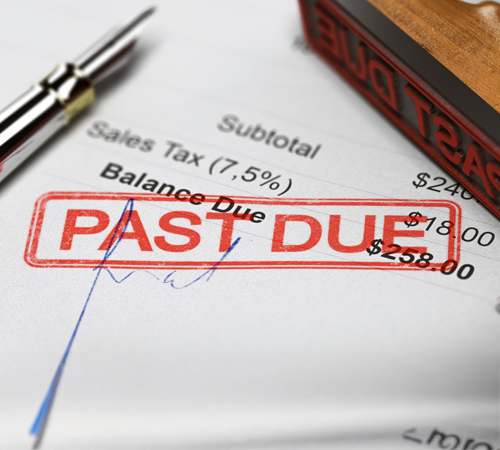

Is Plaid Safe to Use?

"When using financial apps, I’m often redirected to the Plaid network and asked to give personal information. Can I feel safe using Plaid?"

So you’re asked to share your banking information and alarm bells in your head start ringing — as they should! The good news, though, is that, if the financial app you’re using is powered by Plaid, it’s safe to use. Plaid is a reputable company that uses encryption and industry-standard security measures to protect your information.

Micro-Deposit Scams

Scammers are always upping their game, and they’ve recently pulled out an old trick: the micro-deposit scam. Unfortunately, too many people have already fallen victim, and we don’t want anyone else getting caught in the trap. To that end, we’ve compiled this guide on micro-deposit scams, how they play out and what you can do if you’re targeted.

Beware of tax season scammers

It’s tax season, and the scammers are at it again! Beat them at their game by knowing what to look out for.

The Benefits of Using Mobile Payments

No more fumbling through your wallet at checkout or forgetting it at home, now you can pay with your phone!

81% of Americans own smartphones and contactless payments by digital wallet and mobile payment apps are now more popular than ever. Contactless payment is also becoming increasingly available at checkout counters across the country, with six in every 10 retailers accepting digital payments, according to research by the National Retail Federation.

Beware of the Pending Package Scam

Everyone loves a surprise package, and scammers are taking the excitement out of that experience by using bogus packages as a cover for a nefarious scam that tricks victims into sharing personal information. Here’s all you need to know about the pending package scam:

How Can I Protect Myself from Payment App Scams?

There’s been an increase in scams through mobile payment apps such as Cash App, Venmo, Zelle, and more. These apps are still very safe to use, but we want to help protect you.